Understanding Time-of-Day Execution

Most traders treat the market as if it behaves identically 24/7.

But crypto operates in liquidity waves, where each global session carries unique volatility, liquidity density, stop-hunting philosophy, and market-maker behavior.

Understanding time-of-day mechanics allows you to anticipate when breakouts will succeed, when sweeps are engineered, when consolidation is intentional, and when volatility will expand.

Execution is not only where you enter — it’s when you enter.

This page unlocks the real-time structure behind daily trading cycles.

Why Time-of-Day Matters: Liquidity Distribution, Not Clock Time

The market does not care about your local time — it cares about liquidity availability.

Liquidity changes throughout the day because:

♦ different regions trade at different times

♦ volume concentrates around session opens

♦ market-makers reposition in predictable windows

♦ liquidation engines activate as volatility changes

♦ institutional algorithms shift behavior between sessions

Diamonds:

♦ time affects liquidity

♦ liquidity affects structure

♦ therefore time affects structure

Your execution quality is directly tied to the session environment.

Asia (00:00–06:00 UTC) is the quietest but most structurally meaningful session.

The Asia Session: Accumulation, Engineered Ranges, and Whispers of Direction

Characteristics:

♦ thin liquidity

♦ engineered sweeps

♦ range development for the day

♦ microstructure hints of upcoming trend

♦ fake breakouts to trap impatient traders

Asia rarely produces the main move — it prepares the liquidity.

Diamonds:

♦ Asia sets the trap

♦ Asia creates inducement

♦ Asia builds the liquidity map

Your job is not to trade Asia aggressively — it’s to read the blueprint it creates.

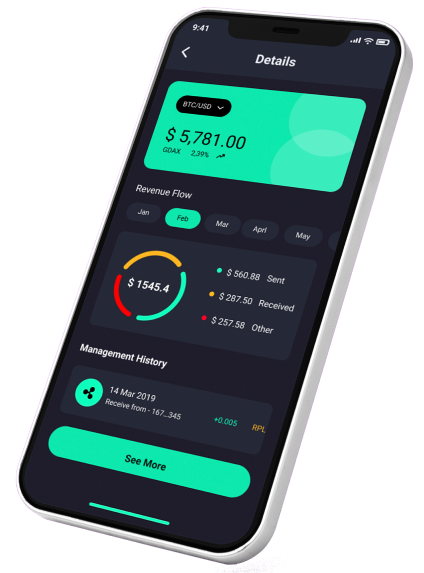

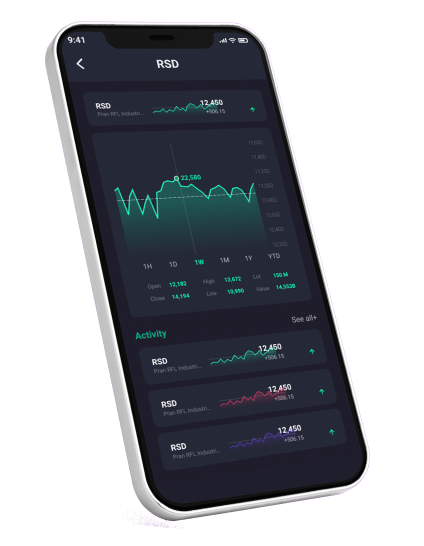

Portfolio Strategy Built Around Your Goals

Receive a complete, coin-by-coin analysis of your portfolio with structured risk evaluation, allocation guidance, and clear improvement suggestions. Turn scattered holdings into a disciplined, strategic investment plan.

The EU Session: Activation, Expansion Tests, and Early Trend Signals

Europe (06:00–12:00 UTC) brings the day’s first meaningful volume.

Characteristics:

♦ displacement begins

♦ internal structure flips more clearly

♦ liquidity from Asia gets harvested

♦ trend direction becomes visible

♦ volatility expands moderately

EU session provides the first real trend attempt of the day.

Bullish EU signal:

♦ downside sweep + upward displacement

Bearish EU signal:

♦ upside sweep + downward displacement

Diamonds:

♦ EU exposes the day’s bias

♦ EU cleans Asia’s traps

♦ EU creates the pre-US structure

This session is ideal for early positioning if structure aligns.

The US session (12:00–20:00 UTC) is the global center of crypto volatility.

The US Session: True Volatility Engine and Trend Confirmation

Characteristics:

♦ major expansions

♦ violent sweeps

♦ fake moves followed by true moves

♦ liquidity saturation

♦ high-impact displacement

US Open (13:30 UTC) is the most dangerous and profitable window.

Common patterns:

♦ sweep → displacement → continuation

♦ aggressive stop hunts before the real move

♦ HTF liquidity targets reached during US hours

Diamonds:

♦ US session decides the trend of the day

♦ US session invalidates weak setups

♦ US session is where conviction trades emerge

Most professional entries are timed around US liquidity.

Targeted Altcoin Analysis for Smarter Decisions

Get a manually crafted, expert-level breakdown of any altcoin you choose. Understand market structure, fundamentals, risk areas, and potential scenarios with clarity — no noise, no guesswork, just professional insight.

Daily Liquidity Flow: The 3-Wave Intraday Structure

Every day tends to follow a repeatable three-wave liquidity cycle:

Wave 1 — Asia accumulation

→ build liquidity pockets

→ create sweeps

→ engineer range

Wave 2 — EU activation

→ test breakout direction

→ create first displacement

→ sweep Asia’s extremes

Wave 3 — US resolution

→ confirm or reverse EU’s move

→ deliver main trend

→ hit external liquidity targets

Diamonds:

♦ intraday structure mirrors HTF behavior

♦ every day is its own liquidity cycle

♦ reading waves gives you timing precision

These three waves guide when your entries have real probability.

Time-of-Day Impact on Setups and Execution Confidence

Different setups perform differently across sessions.

Asia Session:

♦ best for mean-reversion scalps

♦ poor for breakout trades

♦ ideal for watching sweeps, not trading them

EU Session:

♦ best for early trend entries

♦ great for microstructure flips

♦ moderate for continuation trades

US Session:

♦ best for high-conviction trends

♦ ideal for momentum trading

♦ dangerous for counter-trend trades

♦ excellent for targeting external liquidity

Diamonds:

♦ don’t force trend entries in Asia

♦ don’t fade strong moves during US

♦ align your strategy with the session’s intent

Execution timing is an edge — not a coincidence.

Creating a Time-of-Day Execution Filter

A professional framework:

1. Identify session environment

→ Are we in Asia, EU, or US?

2. Define liquidity condition

→ Have major sweeps happened?

→ Is displacement present?

3. Limit strategies to session-specific behavior

Asia:

♦ fade sweeps only

♦ avoid breakout attempts

EU:

♦ follow first displacement

♦ enter on micro flips

US:

♦ trade continuation

♦ trade the resolution move

4. Avoid times that historically produce chop

♦ mid-EU (09:00–11:00 UTC)

♦ late US (after 18:00 UTC) unless trending strongly

Diamonds:

♦ time filtering increases winrate dramatically

♦ you remove trades with no liquidity backing

♦ timing becomes part of your strategy, not luck

A time-of-day filter cuts out 60–70% of low-quality trades.

Understand the Market Before It Moves

Get a professional overview of market structure, macro behavior, dominance trends, and major cycles. Designed for traders who want clarity on the broader environment before making critical decisions.

Final Execution Model Using Time-of-Day Logic

A complete execution blueprint:

1. Let Asia build the trap

➤ Identify equal highs/lows

➤ Mark sweep zones

➤ Avoid entries unless structural

2. Trade EU activation

➤ Look for sweep → displacement

➤ Enter on FVG / breaker retest

➤ Confirm HTF alignment

3. Ride US continuation

➤ Expect volatility

➤ Let US invalidate or confirm EU move

➤ Exit at external liquidity

Diamonds:

♦ session stacking produces mechanical precision

♦ entries have meaning only when liquidity aligns

♦ time-of-day mastery reduces randomness in your execution

When you know when to trade, where becomes far easier.

FINAL SUMMARY

Time-of-day execution is a fundamental trading edge.

It helps you understand:

♦ where liquidity will form

♦ where sweeps will occur

♦ when displacement has meaning

♦ when volatility matters

♦ how intraday trends evolve

Sessions shape structure.

Structure shapes opportunity.

Opportunity is unlocked through timing.

Master time-of-day execution and you stop fighting the market —

you trade in sync with its daily rhythm.

Continue Your Trading Strategy & Execution Mastery — Advanced Reads on Strategy Design, Execution Logic, and Decision Frameworks

Refine how you translate market analysis into actionable trading decisions through structured strategy design, execution logic, and rule-based frameworks.

These curated reads focus on entry and exit modeling, execution timing, position management, multi-timeframe decision flow, and strategy integration — helping you move from analysis to consistent execution with clarity, discipline, and professional-grade trading systems.