Liquidity-Driven Entry Timing

Most traders look for indicators, patterns, or “signals” to determine when to enter a trade.

Professional traders look for something very different:

liquidity behavior.

The market moves not because of candles or indicators, but because of:

◆ liquidity imbalances

◆ engineered inefficiencies

◆ accumulation of resting orders

◆ sweeps that reset positioning

◆ institutional displacement events

Every major move — continuation or reversal — begins with a liquidity event.

Every professional trader builds their timing model around it.

This guide reveals how to identify and anticipate the exact moments when institutions begin to engage, allowing you to enter trades with precision, confidence, and superior R-multiples.

Why Liquidity Timing Is the Core of Professional Entries

The market does not move randomly. It moves when large players:

◆ collect liquidity

◆ trap participants

◆ rebalance exposure

◆ execute directional flow

◆ remove opposing orders

Understanding liquidity timing gives traders:

◆ early entries with reduced risk

◆ superior stop placement

◆ cleaner structure alignment

◆ access to moves before they fully develop

◆ better accuracy during volatility shifts

Liquidity timing reveals when a move begins, not just where.

The Three Phases of Institutional Liquidity Behavior

Professional timing models revolve around three core liquidity phases:

Phase 1: Liquidity Build-Up

Price compresses, pauses, or coils as the market builds resting orders.

Characteristics:

◆ clean highs/lows forming liquidity shelves

◆ narrowing volatility ranges

◆ formation of equal highs/lows

◆ increasing inefficiency around key zones

Institutions wait here.

Retail traders become complacent — perfect conditions for manipulation.

Phase 2: Liquidity Removal (Sweeps)

The market aggressively targets liquidity pockets to clear the path for a directional move.

Look for:

◆ sharp wicks beyond key highs or lows

◆ quick rejection or reclaim after sweep

◆ aggressive volume spike

◆ displacement immediately following

This is the moment institutions “unlock” the move.

Phase 3: Displacement & Continuation

Once liquidity is removed, the market has fuel.

Displacement confirms real intention.

Characteristics include:

◆ strong directional candle bodies

◆ imbalanced movement leaving inefficiency

◆ break of micro/mid structure

◆ multi-leg continuation

This is the highest-probability moment to enter with precision.

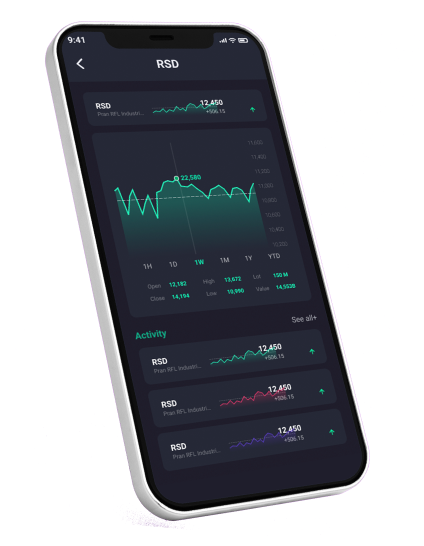

Portfolio Strategy Built Around Your Goals

Receive a complete, coin-by-coin analysis of your portfolio with structured risk evaluation, allocation guidance, and clear improvement suggestions. Turn scattered holdings into a disciplined, strategic investment plan.

Liquidity Maps: The Foundation of Precise Entry Timing

Professional traders build a liquidity map before constructing entry models. This map identifies the zones where institutions are most likely to engage.

Key liquidity elements:

◆ obvious swing highs and lows

◆ equal highs or equal lows (retail magnets)

◆ imbalances, inefficiencies, or gaps

◆ volume-based shelves and “resting liquidity pockets”

◆ major reclaim/rejection zones

Your entry must align with liquidity mechanics — not candle aesthetics.

The goal is to enter after liquidity is harvested, not before.

The Mechanics of Liquidity Sweeps: Predicting When the Trap Will Trigger

Sweeps are the clearest indication of institutional interest.

They show exactly where the market needed to go to free up movement.

A professional sweep has:

◆ a deliberate extension beyond the liquidity shelf

◆ a clear rejection or stabilization after the spike

◆ a return back inside structure

◆ immediate or slightly delayed displacement

Weak sweeps include:

◆ slow drift beyond a high/low without purpose

◆ weak reclaim

◆ no displacement following

◆ absence of volume shift

Professional timing requires distinguishing fake sweeps from engineered sweeps.

Targeted Altcoin Analysis for Smarter Decisions

Get a manually crafted, expert-level breakdown of any altcoin you choose. Understand market structure, fundamentals, risk areas, and potential scenarios with clarity — no noise, no guesswork, just professional insight.

Displacement: The Moment the Market Reveals True Direction

Displacement is the most reliable indicator of institutional engagement.

It appears as a strong, imbalanced movement in one direction.

Displacement features:

◆ large-bodied candles with directional conviction

◆ violation of internal structure

◆ removal of counter-trend micro levels

◆ creation of inefficiencies (imbalances)

◆ a follow-through attempt confirming intention

Entry before displacement is prediction.

Entry after displacement is precision.

Liquidity-Driven Entry Models: How Professionals Time Precision Entries

Below are the primary models used by high-level traders.

Model 1: Sweep → Reclaim → Entry

The most classic and reliable liquidity model.

Process:

◆ liquidity buildup

◆ engineered sweep of highs/lows

◆ strong reclaim of the prior structure

◆ displacement confirming direction

◆ entry on pullback

Ideal for:

◆ reversals

◆ high R setups

◆ momentum continuation after trap

Model 2: Inefficiency Fill → Continuation Entry

Institutions often rebalance price by filling inefficiencies before continuing.

Process:

◆ displacement creates imbalance

◆ market retraces into the imbalance

◆ liquidity is collected

◆ continuation follows

This model gives extremely tight invalidation and clean risk control.

Model 3: Volatility Compression Breakout

When price compresses tightly, the breakout is often a liquidity-driven event.

Process:

◆ narrowing ranges

◆ equal highs or lows forming

◆ volatility collapsing

◆ liquidity sitting on both sides

◆ aggressive expansion after breakout

Entry occurs on reclaim or continuation confirmation — never blind breakout entries.

Model 4: Session Liquidity Timing

Certain moments of the day naturally coincide with institutional engagement.

Highest-probability timing zones:

◆ London Kill Zone

◆ New York Open

◆ NYSE Open

◆ Post-London Close volatility shift

Professionals know which session “carries the liquidity baton.”

Volatility Timing: Liquidity Moves Only When Volatility Allows

Liquidity timing and volatility timing are deeply connected.

Without volatility, liquidity events lack follow-through.

Professional volatility cues:

◆ ATR shifts

◆ compression → expansion transitions

◆ post-news volatility funnels

◆ momentum ignition signals

Volatility is the accelerator for liquidity-driven entries.

Understand the Market Before It Moves

Get a professional overview of market structure, macro behavior, dominance trends, and major cycles. Designed for traders who want clarity on the broader environment before making critical decisions.

Risk Management in Liquidity Timing Models

Liquidity entries offer elite precision — but only with disciplined risk.

Professional risk rules:

◆ invalidation = the point where structure is broken, not the entry wick

◆ stop placement goes beyond the sweep or inefficiency, not inside it

◆ size adjusts based on volatility and distance to invalidation

◆ avoid stacking entries in unclear liquidity environments

Liquidity gives precision.

Precision demands discipline.

Common Retail Mistakes in Liquidity-Based Timing

Retail traders frequently misunderstand liquidity timing.

The biggest errors:

◆ entering before the sweep

◆ entering during the wick

◆ ignoring displacement

◆ placing stops inside liquidity zones

◆ taking every sweep as reversal

◆ chasing after a strong displacement leg

Liqudity is not just movement — it’s intentional engineering.

Understanding the intention makes the timing obvious.

Data-Driven Timing Refinement: Optimizing Through Journaling & Backtesting

To perfect liquidity timing, professionals track:

◆ the sweep characteristics before winning trades

◆ volatility states associated with clean entries

◆ which sweeps fail and why

◆ which displacement signatures predict continuation

◆ session-based timing success rates

◆ optimal pullback depth after sweep → reclaim

Data reveals the trader’s unique timing edge.

Your goal is not to copy —

it’s to refine your own precision through evidence.

Final Evaluation & Strategic Takeaways

Liquidity-driven entry timing transforms trading by:

◆ revealing exactly when institutions enter the market

◆ eliminating low-quality, premature trades

◆ improving entry precision and R-multiples

◆ aligning your execution with structural intention

◆ reducing emotional uncertainty

◆ creating a repeatable timing framework usable across all markets

The market moves for one reason:

liquidity must be collected.

When you learn to anticipate when that liquidity will be targeted —

your timing becomes professional.

Liquidity is the language of the market.

Timing is your translation.

Continue Your Trading Strategy & Execution Mastery — Advanced Reads on Strategy Design, Execution Logic, and Decision Frameworks

Refine how you translate market analysis into actionable trading decisions through structured strategy design, execution logic, and rule-based frameworks.

These curated reads focus on entry and exit modeling, execution timing, position management, multi-timeframe decision flow, and strategy integration — helping you move from analysis to consistent execution with clarity, discipline, and professional-grade trading systems.