THE PROFESSIONAL SYSTEM FOR CONSISTENCY, PRECISION & SCALABLE PERFORMANCE

TRADING STRATEGY & EXECUTION

Execution is the ultimate differentiator between amateur and professional traders.

It is not enough to understand market structure, liquidity, narratives, or risk — those are the foundations.

What determines long-term profitability is the ability to systematically convert analysis into action with precision, consistency, emotional neutrality, and strategic positioning.

Trading is not guessing and it is not reacting.

It is the engineered process of identifying high-probability conditions, aligning them across multiple risk and structural layers, and executing with controlled exposure.

This mother page deconstructs the complete institutional execution methodology used by elite traders, funds, and algorithmic systems to thrive in volatile markets like crypto.

Systems, structure, rules & repeatability

The Architecture of a Professional Trading Strategy

A trading strategy is not a set of signals.

It is a logic engine, built on clearly defined conditions, environments, triggers, risk parameters, and execution rules.

A real professional strategy includes:

♦ Market environment classification — trending, ranging, transitional, expansion, compression

♦ Directional framework — bias derived from HTF structure, liquidity flow, and macro context

♦ Entry logic — precise triggers, invalidation rules, execution filters

♦ Exit logic — profit-taking structure, partial exits, volatility-adjusted exits

♦ Risk integration — position sizing, stop placement, risk-per-trade

♦ System constraints — what NOT to trade, when NOT to trade, which environments are forbidden

♦ Feedback cycle — reviews, metrics, adjustments, iteration loops

A good strategy is not the one with the best entries — it is the one that you can execute consistently, without deviation, across hundreds of trades.

Professionals don’t rely on flexibility.

They rely on rules, logic, and no-discretion frameworks that eliminate decision fatigue.

Recognizing high-probability opportunities across structure, liquidity & momentum

Trade Identification

Trade identification is the art of spotting conditions — not guessing outcomes.

Professionals never enter because “it looks good.” They enter because:

♦ Structure aligns: HTF → MTF → LTF show the same directional logic

♦ Liquidity confirms: liquidity above or below is vulnerable, targeted, or collected

♦ Momentum supports: displacement, expansion, continuation pressure

♦ Volatility is favorable: not chaotic, not compressed, not trapped

♦ Environment fits strategy: avoid transitional chaos, hunt structured conditions

Professional trade identification is slow, methodical, and deeply analytical.

It focuses on why this environment produces opportunity, not on chart patterns.

The best traders do not take more trades — they filter more aggressively.

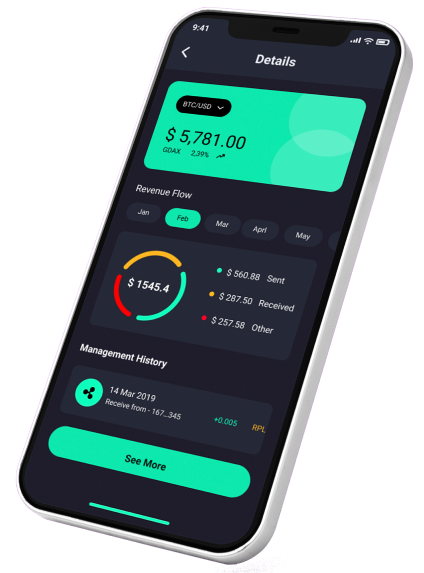

Portfolio Strategy Built Around Your Goals

Receive a complete, coin-by-coin analysis of your portfolio with structured risk evaluation, allocation guidance, and clear improvement suggestions. Turn scattered holdings into a disciplined, strategic investment plan.

Execution Mastery: Timing, precision, and microstructure-based entry optimization

Execution is where 95% of retail breaks.

They identify the idea correctly — but execute emotionally, too early, too late, or with wrong sizing.

Professional execution requires mastery of microstructure:

♦ Refinement through LTF structure: entering on refined breaks, retests, liquidity grabs, or micro displacement

♦ Understanding spread & slippage: sizing based on liquidity available

♦ Execution windows: entering only when volatility, timing, and structure align

♦ Stop optimization: placing stops outside noise zones, within logical invalidation areas

♦ Avoiding weak confirmation: hesitation candles, low-volume retests, sloppy structure

♦ Timing with narrative flow: aligning execution with event cycles, news sensitivity, funding shifts

Precision execution isn’t about perfect entries — it’s about consistent entries that avoid unnecessary risk.

Execution is the most skill-dependent part of trading.

Professionals practice this deliberately, like athletes training mechanics.

Trade Management: Adaptive scaling, reduction, risk control & maximizing asymmetry

Trade management is where profits are captured or destroyed.

Professionals don’t “set and forget.” They manage trades dynamically based on:

♦ Volatility expansion: scaling out during high energy

♦ Structural breaks: adjusting stops when market confirms direction

♦ Liquidity sweeps: taking partial profit when liquidity is harvested

♦ Narrative shifts: reducing exposure when environment weakens

♦ Time decay: exiting when the setup becomes stale

♦ Scaling techniques: pyramiding, inverse scaling, dynamic scaling

Trade management aligns with risk, not ego.

The goal is not to “maximize wins.”

The goal is to maximize asymmetry — small controlled losses, large structured wins.

Exit Strategy Engineering: Designing exits that protect capital and lock in performance consistently

Exits determine your PnL more than entries ever will.

Professional exits consider:

♦ Structural exit zones: previous highs/lows, inefficiencies, liquidity magnets

♦ Momentum exit signals: slowing displacement, reduced volume, volatility compression

♦ Risk-adjusted exit protocols: partials at 1R, 2R, or structural zones

♦ Time-based exits: leaving stale trades that no longer align with structure

♦ Environmental exits: exiting when macro or micro environment becomes hostile

♦ Psychological exits: engineered to avoid fear-driven or greed-driven mistakes

Exit engineering is a discipline.

Professionals script their exits before entering the trade — retail improvises and pays the price.

Targeted Altcoin Analysis for Smarter Decisions

Get a manually crafted, expert-level breakdown of any altcoin you choose. Understand market structure, fundamentals, risk areas, and potential scenarios with clarity — no noise, no guesswork, just professional insight.

The Execution Environment: Volatility regimes, liquidity conditions & narrative timing

The execution environment is the context in which a strategy operates.

Professionals classify environments before trading:

♦ High-vol environment: ideal for breakout continuation, dangerous for mean reversion

♦ Low-vol environment: ideal for accumulation plays, dangerous for breakout traders

♦ Liquidity-rich environment: clean execution, stable structure

♦ Liquidity-poor environment: slippage, wicks, fakeouts

♦ Narrative-aligned environment: high follow-through potential

♦ Narrative-dead environment: sluggish, manipulative, unpredictable

Your strategy’s win-rate is determined by how well it matches the current environment.

Professionals don’t force their system into the wrong conditions.

Retail does — that’s why they lose.

Trade Journaling & Performance Optimization: Turning execution into a learning engine

A professional trader is not trying to “be right.”

They are trying to improve.

A high-level journal tracks:

♦ exact entry conditions

♦ environment classification

♦ emotional state

♦ microstructure notes

♦ volatility regime

♦ liquidity condition

♦ narrative context

♦ exit logic

♦ rule adherence score

♦ trade quality score

This allows traders to identify patterns in their behavior, weaknesses in their execution, environments where their strategy thrives, and conditions that consistently cause losses.

A journal is not documentation — it is a performance amplifier.

Understand the Market Before It Moves

Get a professional overview of market structure, macro behavior, dominance trends, and major cycles. Designed for traders who want clarity on the broader environment before making critical decisions.

The Professional Execution Framework: A complete system for turning analysis into consistent action

A full institutional execution system includes:

♦ Environment scan → trending? ranging? transitional?

♦ Directional bias → derived from HTF structure, liquidity, momentum

♦ Setup identification → strict conditions, not intuition

♦ Execution window → volatility, microstructure, timing

♦ Position sizing → volatility-adjusted, correlation-adjusted

♦ Trade management → partials, stop movement, volatility monitoring

♦ Exit engineering → structural targets, time decay, risk-off switches

♦ Performance review → journaling, metrics, adaptation

Execution is not luck.

Execution is not talent.

Execution is system design.

When analysis and execution merge into a unified framework, trading becomes reliable, scalable, and emotionally sustainable.

Common questions

Trading strategy and execution are the final evolution of a trader’s skill set. They represent the point where knowledge transforms into consistent action, where structure becomes timing, and where risk becomes controlled precision.

Most traders fail not because they lack intelligence, but because they attempt to execute without a system — they enter based on feelings, exit based on fear, and size based on hope. They treat trading like prediction instead of engineered decision-making.

Professional execution eliminates randomness.

It transforms the trader from a reactive participant into an architect of decisions.

Every trade begins with environment identification, directional clarity, and structural mapping.

Entries are timed through microstructure confirmation.

Exits follow predesigned logic paths.

Risk is measured mathematically, not emotionally.

Performance is tracked through structured journaling that reveals hidden behavioral biases and execution leaks.

When execution becomes a system, trading becomes scalable.

When execution becomes consistent, performance becomes stable.

The market will always be uncertain — but a professional execution framework creates certainty in how you behave within that uncertainty.

This is the true foundation of long-term profitability, and the core reason that institutional traders survive while retail is repeatedly destroyed.

Why do traders fail to execute even when they understand technical analysis?

Because TA knowledge does not equal execution ability.

The market punishes hesitation, emotional reaction, misaligned timing, poor sizing, and structural misunderstanding. Most traders “understand” charts but cannot translate that understanding into professional action.

Execution fails when:

♦ Analysis isn’t connected to rules: Traders see an idea but have no predefined entry logic, risk plan, or exit protocol.

♦ Emotions override logic: Fear of missing out, fear of loss, overconfidence after wins, panic during volatility — all distort execution timing.

♦ Environments aren’t classified: Traders use the wrong strategy in the wrong type of market (breakout system in a range, reversal system in a trend).

♦ Risk is not controlled: Even correct entries fail when sizing is too big for the volatility regime.

♦ Microstructure is ignored: Entries inside noise zones get liquidated before the real move starts.

♦ No execution playbook exists: Professionals follow scripts; amateurs improvise under pressure.

Technical analysis shows where opportunity exists.

Execution determines whether that opportunity becomes a profit or a catastrophic psychological spiral.

Understanding without execution is the illusion of skill.

How do professionals time entries with precision without chasing or hesitating?

Professionals rely on execution windows, not instincts.

They time entries by isolating microstructure behaviors — the tiny structural signals that confirm or deny the presence of institutional movement.

♦ Liquidity confirmation: entry after liquidity grab or sweep, not before

♦ Micro-displacement: LTF impulse confirming directional bias

♦ Low-risk retest windows: refined pullbacks into imbalance or structural pivot

♦ Volatility alignment: entering only when volatility compresses into expansion potential

♦ Invalidation clarity: entries are only taken where stops can be placed logically outside noise

♦ Narrative scripting: they wait for liquidity events (news, unlocks, sessions) before executing

Professionals never chase because they never rely on “reactive entries.”

They wait for their environment + structure + liquidity + timing all to align, and only then do they strike.

Execution precision is a function of patience and rule-based timing — not speed.

What is the biggest mistake traders make when managing trades after entering?

The biggest mistake is managing trades emotionally instead of structurally.

Retail traders treat the open trade like a threat instead of a process.

♦ Moving stops emotionally: tightening too early or removing stops entirely

♦ Taking profit prematurely: exiting winners at the first sign of volatility

♦ Ignoring volatility expansion: staying in positions that are becoming structurally dangerous

♦ No partial management: missing opportunities to secure profits while still letting the system run

♦ Failing to react to narrative shifts: managing trades as if nothing changed

♦ Letting losers become catastrophic: refusing to close invalidated trades

Professional trade management is the opposite:

→ they reduce exposure when volatility shifts

→ they scale out at predetermined liquidity zones

→ they track whether momentum is sustaining or dying

→ they exit objectively when invalidation is hit, not emotionally

Trade management is where profitability is enforced.

Even perfect entries are meaningless without engineered management protocols.

How do professionals remain consistent when the market environment constantly changes?

Because they don’t treat trading as a single strategy — they treat it as a multi-layer execution engine that adapts before the environment becomes hostile.

Professionals maintain consistency through:

♦ Environment classification: knowing whether the market is trending, ranging, transitional, or volatile

♦ Strategy switching rules: each strategy is only active in its optimal environment

♦ Daily/weekly bias tracking: directional bias is updated as structure shifts

♦ Volatility regime adaptation: sizing, stops, and entry methods change with volatility

♦ Risk throttling: reducing exposure during hostile conditions (FOMC, low liquidity, narrative decay)

♦ External neutrality: they ignore noise, influencers, hype, and emotional community waves

Consistency is not about predicting the market correctly.

Consistency is about never applying the wrong system to the wrong environment.

This is the hallmark of professional trading discipline.