THE COMPLETE PROFESSIONAL FOUNDATION FOR HOW MARKETS TRULY MOVE

LIQUIDITY & ORDER FLOW

Liquidity is the engine of every financial market — the hidden infrastructure that determines how far price can travel, how fast it can accelerate, when it must slow down, where it will reverse, and which participants will be forced into liquidation.

Crypto, with its thinner liquidity and higher volatility, exposes these mechanics more clearly than any other asset class.

This pillar is a deep exploration of the forces beneath the chart: stop clusters, inefficiencies, displacement, order flow aggression, institutional intent, and the liquidity cycles that shape every trend, reversal, compression and expansion.

Understanding liquidity is understanding the physics of the market — the governing laws beneath every candle.

Depth, fragility, energy, and the hidden structure beneath price

The True Nature of Liquidity

Liquidity is not just “volume” — it is a complex system of available orders, execution pathways, absorption points, and risk pockets.

Crypto markets are especially reactive to liquidity imbalances because liquidity is fragmented across exchanges, pairs, and timeframes.

When traders begin to see liquidity as an ecosystem rather than a metric, the entire market reveals itself.

♦ Liquidity exists in layers: visible liquidity, hidden liquidity, algorithmic liquidity, and conditional liquidity

♦ Deep liquidity creates stable price movement, narrow spreads, and reliable trend continuation

♦ Thin liquidity creates explosive volatility, wicked wicks, momentum distortion, and rapid displacements

♦ Liquidity depth determines whether price can expand smoothly or must violently gather orders

♦ Execution flow reveals where the market can process large trades without disruption

♦ Markets do not “choose” direction — they seek liquidity like gravity seeking mass

Crypto traders who grasp these layers understand why the market behaves violently at times and eerily calm at others — it is reacting to the availability, density, and positioning of liquidity across the ecosystem.

Why price must hunt trader positions

Liquidity Pools, Stop Clusters, and Forced Movement

Stop losses represent stored liquidity, and stored liquidity represents opportunity for large players.

When thousands of traders place stops at obvious levels, they create predictable liquidity pockets that market makers can use to fill major orders.

♦ Liquidity pools form above equal highs, equal lows, consolidation tops, swing points, and trendline touches

♦ Retail clustering around “obvious” levels becomes a roadmap for institutional execution

♦ Stop runs are not manipulation — they are execution events required to fill large positioning

♦ Price often only expands once it has collected enough opposing orders to support the move

♦ Wicks into liquidity pools are signatures of institutional absorption

♦ When liquidity above or below structure is cleared, price frequently stabilizes, reverses, or accelerates

Understanding that price hunts liquidity by design — not accident — transforms trading from emotional guessing into mechanical interpretation.

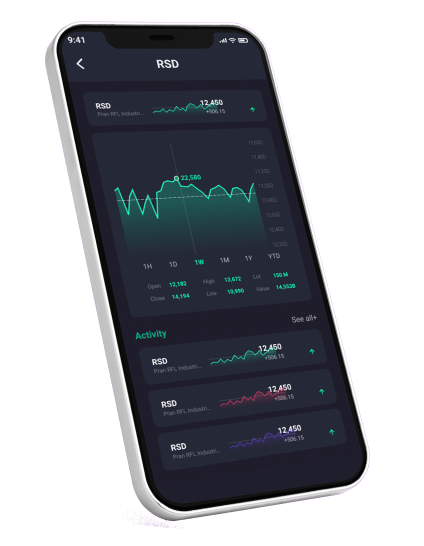

Portfolio Strategy Built Around Your Goals

Receive a complete, coin-by-coin analysis of your portfolio with structured risk evaluation, allocation guidance, and clear improvement suggestions. Turn scattered holdings into a disciplined, strategic investment plan.

Inefficiencies, Imbalances & the Market’s Obligation to Rebalance

When price moves aggressively, it leaves behind voids — areas where little to no trading occurred.

These inefficiencies create powerful future targets because the market seeks equilibrium.

♦ Imbalances form when price expands with such aggression that opposing orders cannot fill

♦ Inefficiencies represent skipped trading, missing data, and disrupted fair value

♦ Markets naturally return to rebalance inefficient zones to restore structural symmetry

♦ Massive imbalance zones forecast future retracements or deep liquidity grabs

♦ Fair value regions often sit between major imbalance extremes

♦ Close of imbalance zones can serve as launchpads for continuation or reversal

The study of inefficiencies gives traders predictive power over future price paths — long before most participants recognize the turning points.

Displacement, Institutional Aggression & Directional Commitment

Displacement is the most important structural signal of institutional behavior.

It shows when one side of the market has decisively overpowered the other, creating a clean, powerful break in structure.

♦ Displacement candles represent high-intent, high-conviction institutional activity

♦ Sharp breaks of structure are almost always driven by intense liquidity absorption

♦ True displacement is followed by weak, shallow pullbacks — evidence of strong control

♦ Displacement creates directional anchors: it tells the trader which side has “claimed” the market

♦ Weak displacement signals hesitation and narrative uncertainty

♦ Clean displacement followed by rebalancing often marks the start of new macro legs

When a trader correctly identifies displacement, they can forecast directional movement with far greater accuracy — because they’re identifying actual institutional commitment.

Order Flow Behavior, Trader Psychology & Liquidity-Induced Emotion Cycles

Order flow is the heartbeat of the market — the stream of executed trades that reveals who is winning, who is losing, and who is being forced out.

Behind every candle is a story of emotion, fear, aggression, hesitation, and capitulation.

♦ Rising order flow without range expansion reveals hidden absorption

♦ Chaotic order flow with wide wicks shows liquidity fragmentation

♦ Trapped traders create forced cascades when liquidation triggers

♦ Emotional trading leaves structural footprints: panic lows, euphoria highs, exhaustion breaks

♦ Order flow distortion exposes liquidity vacuums and future violent moves

♦ Institutional algorithms use predictable human behavior to engineer liquidity creation

Once a trader understands the psychological geometry of order flow, every candle begins to make logical sense — no more randomness.

Targeted Altcoin Analysis for Smarter Decisions

Get a manually crafted, expert-level breakdown of any altcoin you choose. Understand market structure, fundamentals, risk areas, and potential scenarios with clarity — no noise, no guesswork, just professional insight.

Liquidity Zones, Value Areas & the Geography of Price Delivery

Liquidity zones represent the geographical map of the market — the regions where price has the highest probability of reacting, stabilizing, or expanding.

♦ Zones of high liquidity density act like magnets

♦ Premium zones (above equilibrium) attract short positioning and distribution

♦ Discount zones (below equilibrium) attract accumulation

♦ Price repeatedly returns to zones where significant liquidity was previously processed

♦ Value areas form where buyers and sellers reached temporary agreement

♦ Liquidity voids between zones create high-volatility travel corridors

A trader who maps liquidity zones correctly can forecast:

→ where price is heading

→ where it’s likely to stall

→ where reversals can occur

→ where liquidity hunts will unfold

This transforms trading from reactive to anticipatory.

The Reality of Institutional Influence: How big players engineer structure, volatility & sentiment

Institutions, whales, and algorithmic liquidity systems dominate crypto.

Their behavior shapes macro trends, manipulates retail expectations, and orchestrates liquidity events.

♦ Institutions accumulate positions inside ranges, not during breakouts

♦ They use engineered volatility to flush retail positioning

♦ They scale into trades during liquidity hunts, not after them

♦ Their footprint appears in displacement, order flow anomalies, and imbalance structure

♦ They manipulate narrative timing to build liquidity where they want it

♦ “Manipulation” is simply institutional efficiency

When traders stop blaming manipulation and start studying institutional mechanics, the market becomes infinitely more readable.

Understand the Market Before It Moves

Get a professional overview of market structure, macro behavior, dominance trends, and major cycles. Designed for traders who want clarity on the broader environment before making critical decisions.

The Complete Liquidity-First Trading Framework: A full professional methodology

A liquidity-first system is the highest form of technical analysis — precise, consistent, and grounded in the market’s internal logic.

♦ Identify HTF liquidity pools and imbalance nodes

♦ Determine directional intent through displacement behavior

♦ Map premium and discount regions for contextual alignment

♦ Observe emerging liquidity traps and transitional compression

♦ Locate zones of institutional accumulation and distribution

♦ Drop to microstructure for timing windows

♦ Execute only when liquidity, structure, and order flow align

This is not just a strategy —

it is a worldview.

A way of seeing the market as a living system driven by liquidity logic, not randomness.

Common questions

Liquidity is the true governing force behind every crypto market — the silent architecture that determines where price travels, how it accelerates, and when it reverses. Traders who rely on indicators, chart patterns, or intuition often experience confusion because these tools describe surface-level behavior, while liquidity reveals the engine beneath.

Every wick, every consolidation, every violent expansion, every failed breakout, and every engineered fakeout is a liquidity event. Price does not “choose” direction — it follows the path of least resistance toward the highest concentration of executable orders. This is why highs get raided before strong downtrends, why lows get swept before rallies, why imbalances get revisited, and why markets rotate through phases of compression and expansion.

Understanding liquidity transforms trading from emotional reaction into analytical clarity. It turns price action into a readable language. Traders begin to anticipate movement rather than chase it. They recognize where participants are trapped, where institutions are accumulating, where energy is building, and where liquidity must be collected next.

This pillar distills the logical structure of liquidity and order flow into a comprehensive framework that traders can use to gain an institutional perspective — one that sees price not as chaos, but as an organized, liquidity-driven machine. Once this perspective becomes natural, market behavior stops being mysterious and starts becoming predictable.

Why does price move toward liquidity instead of following patterns or indicators?

Price does not react to patterns, shapes, or signals — it responds to liquidity availability, because every market must constantly balance execution, order absorption, and efficient flow. Crypto, being thinner and more fragmented than traditional markets, reveals this mechanism even more clearly.

♦ Markets gravitate toward liquidity because major participants need large order volume to execute without excessive slippage

♦ Indicators lag behind liquidity shifts, which is why they often fail during volatility

♦ Patterns do not cause movement — they merely form as a side effect of liquidity dynamics

♦ Price hunts stop-losses because they represent guaranteed liquidity sitting at predictable locations

♦ High-liquidity zones act as magnets, attracting price even when technical patterns disagree

♦ Liquidity is the only “truth” beneath the chart — everything else is an interpretation layered on top

When traders stop seeing price as random and start viewing it as a liquidity-seeking engine, the market becomes dramatically easier to understand.

Liquidity explains movement before structure forms — giving traders foresight instead of hindsight.

Is liquidity hunting the same as market manipulation?

No — liquidity hunting is not manipulation; it is a structural requirement of all markets, especially crypto. What retail calls “manipulation” is simply the natural behavior of liquidity-seeking participants executing optimally within a fragmented ecosystem.

♦ Stop-loss clusters create pockets of guaranteed orders, which institutions can use to fill large positions

♦ Price must clear liquidity above highs or below lows before continuing, because it needs volume to justify expansion

♦ Liquidity grabs often precede major trend continuation because they remove weak hands from the market

♦ Wicks into liquidity pools are not accidents — they are displacement events engineered by order flow

♦ Markets cannot move without liquidity, so they naturally gravitate toward stop-rich zones

♦ If institutions didn’t hunt liquidity, price wouldn’t be able to move efficiently at all

Manipulation implies intentional deception; liquidity hunting is simply execution optimization.

Understanding this difference transforms a trader’s psychology from victim mentality → structural mastery.

How can understanding order flow improve timing and reduce losing trades?

Order flow is the real-time representation of buying and selling pressure, and mastering it gives traders a clearer sense of timing than any indicator or pattern.

Most losing trades come from entering during periods of imbalance or emotional volatility — without understanding what the order flow underneath is signaling.

♦ Order flow expansion shows when momentum is supported by real participation

♦ Order flow absorption reveals hidden opposing forces that will soon reverse price

♦ Thin order flow highlights liquidity vacuums where violent wicks are likely

♦ Choppy order flow suggests indecision and warns against premature entries

♦ Sudden order flow bursts signal trap-based liquidity events

♦ Weak pullback order flow indicates continuation; strong reactive order flow signals reversal probability

When traders align entries with order flow confirmation, they avoid entering during traps, fakeouts, or low-liquidity noise.

Timing improves naturally because they are no longer reacting to the appearance of candles — they are responding to the intent behind them.

Why do liquidity concepts predict price movement more accurately than traditional indicators?

Traditional indicators rely on historical data and smoothing formulas, which inherently lag behind the market.

Liquidity concepts, however, are forward-facing, because liquidity must be collected before large movement happens — making it a leading structural factor.

♦ Indicators reflect what has already happened; liquidity shows what must happen next

♦ Liquidity imbalances require rebalancing, giving traders predictive insight

♦ Stop-loss clusters reveal where price will most likely reach

♦ Inefficient structures show where the market skipped proper trading and will revisit

♦ Displacement shows immediate institutional intent, not delayed confirmation

♦ Liquidity zones define price targets far more reliably than indicator signals

Liquidity is not just another tool — it is the foundation of market movement.

It predicts price because price follows liquidity, not indicators.

Once traders internalize this, accuracy improves dramatically.