Crypto exchanges are platforms where you buy, sell, and trade digital assets

What Are Crypto Exchanges? A Simple Guide for Beginners

They are the main entry point into the crypto world for beginners

Understanding how exchanges work helps you avoid mistakes, choose the right platform, and keep your assets safe

A crypto exchange connects buyers and sellers

How Crypto Exchanges Work

It acts as a marketplace where you can trade tokens at current market prices

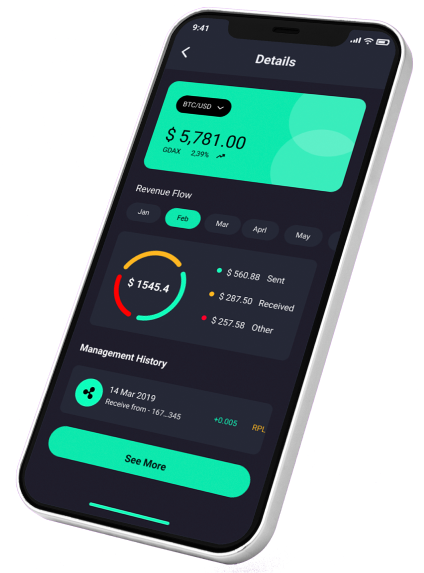

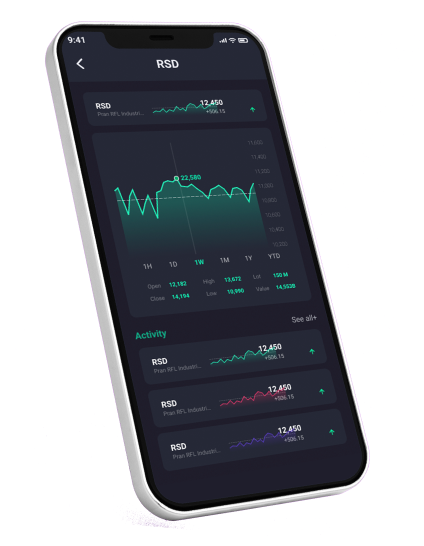

Exchanges provide tools such as:

◆ Trading charts

◆ Market and limit orders

◆ Account balances

◆ Transaction history

◆ Spot and futures markets

You deposit funds, place trades, and withdraw whenever you want

There are two major exchange categories

Centralized vs Decentralized Exchanges

Centralized Exchanges (CEX)

◆ Managed by a company

◆ Easy to use

◆ Fast trading

◆ Customer support available

◆ Requires account verification

Examples include platforms where beginners typically start

Decentralized Exchanges (DEX)

◆ No central authority

◆ You trade directly from your wallet

◆ No account creation

◆ Higher privacy

◆ Smart contract–based

DEXs are powerful but require more knowledge

Portfolio Strategy Built Around Your Goals

Receive a complete, coin-by-coin analysis of your portfolio with structured risk evaluation, allocation guidance, and clear improvement suggestions. Turn scattered holdings into a disciplined, strategic investment plan.

Exchanges offer different types of markets

Spot vs Futures Trading

Spot trading

◆ You buy the actual asset

◆ You own the tokens directly

◆ Simple and beginner-friendly

Futures trading

◆ You trade price movements

◆ Uses leverage

◆ Higher risk

◆ Not recommended for beginners

Spot is the safe starting point for new users

Every exchange charges fees for trading and withdrawals

Exchange Fees Explained

Most common fee types:

◆ Trading fees

◆ Withdrawal fees

◆ Spread differences

◆ Maker and taker fees

Lower fees help beginners keep more of their profits

Targeted Altcoin Analysis for Smarter Decisions

Get a manually crafted, expert-level breakdown of any altcoin you choose. Understand market structure, fundamentals, risk areas, and potential scenarios with clarity — no noise, no guesswork, just professional insight.

Depositing is usually simple

How to Deposit and Withdraw Funds

You can add funds using:

◆ Bank transfer

◆ Credit or debit card

◆ Crypto transfer from another wallet

Withdrawing requires selecting the correct network

Sending crypto to the wrong network can lead to lost funds

Beginners must always check the chosen chain carefully

Even big exchanges can have risks

Security Risks Beginners Must Understand

Common dangers:

◆ Hacked accounts

◆ Phishing links

◆ Fake exchange apps

◆ Withdrawal freezes during extreme conditions

You reduce risk by:

◆ Using strong passwords

◆ Enabling two-factor authentication

◆ Avoiding unknown links

◆ Withdrawing long-term funds to a personal wallet

Exchanges are useful — but not designed for long-term storage

How to Choose the Right Exchange

A good exchange for beginners should offer:

◆ Strong security

◆ Clear interface

◆ Low fees

◆ Reliable customer support

◆ Transparent reputation

◆ Multiple supported assets

Using trusted platforms helps you learn safely without unnecessary complications

Understand the Market Before It Moves

Get a professional overview of market structure, macro behavior, dominance trends, and major cycles. Designed for traders who want clarity on the broader environment before making critical decisions.