THE ADVANCED FOUNDATION FOR READING PRICE WITH PRECISION

TECHNICAL ANALYSIS & MARKET STRUCTURE

Technical Analysis (TA) is not about drawing shapes on a chart — it is the discipline of decoding market logic, liquidity behavior, momentum cycles, and structural flows. It transforms price movement from chaos into an organized language that can be interpreted with clarity and confidence.

This pillar is the complete, full-spectrum guide to understanding the hidden architecture of crypto markets, the forces that drive expansion and correction, and the structural patterns that determine where price must travel next.

Whether you are transitioning from beginner to intermediate or aiming to build a professional, algorithmic mindset, this is the core knowledge that every serious trader must internalize.

The core architecture behind every movement in crypto

Market Structure

Market structure is the blueprint that governs all price action. It reveals the market’s internal logic: who is in control, where liquidity sits, how momentum is shifting, and which scenarios are statistically likely to unfold next.

Structure is not optional for traders — it is the framework upon which all advanced analysis is built.

♦ Market structure defines the sequence of higher highs, higher lows, lower highs, and lower lows that form directional order

♦ Balanced structure shows where buyers and sellers are in temporary equilibrium

♦ Transitional structure reveals instability, upcoming breakouts, and early trend rotation

♦ Trend structure shows the dominant force shaping price flow

♦ Range structure reveals compression before major expansions

♦ Structural failure is the earliest signal of reversal

♦ Price constantly oscillates between premium and discount zones relative to structure

Understanding structure means understanding the market’s operating system.

Once a trader sees structure clearly, fear and confusion disappear — replaced by logic, expectation, and control.

Mapping directional conviction, momentum energy, and wave-based price delivery

Trend Dynamics

Trend analysis is the study of how directional power forms, evolves, accelerates, weakens, and ultimately reverses. Trends are the expressions of liquidity imbalances, narrative shifts, and order flow dominance.

♦ Uptrends form through consistent higher lows fueled by liquidity demand and positive narrative momentum

♦ Downtrends form when supply overwhelms demand, creating persistent lower highs and expansion waves

♦ Momentum waves reveal the psychological intensity of buyers or sellers

♦ Trend exhaustion appears when waves lose range, power, and structural penetration

♦ Counter-trend movements represent liquidity collection, not necessarily new trends

♦ Multi-layered trend behavior creates nested opportunities across timeframes

♦ Where trend strength compresses, volatility energy accumulates

A trend is not “price going up.”

A trend is directional intent combined with structural clarity and energetic continuation.

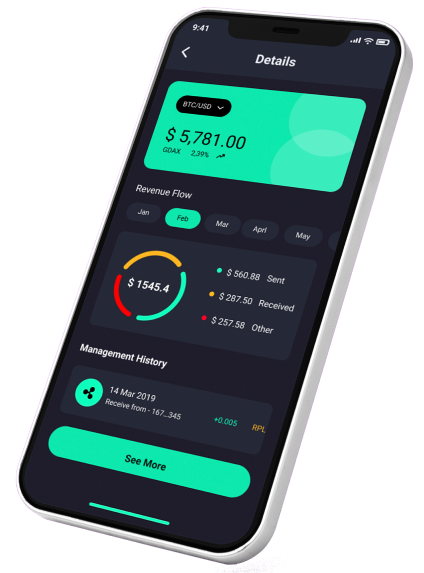

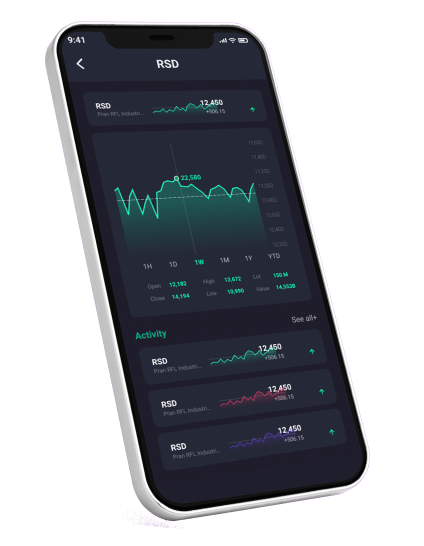

Portfolio Strategy Built Around Your Goals

Receive a complete, coin-by-coin analysis of your portfolio with structured risk evaluation, allocation guidance, and clear improvement suggestions. Turn scattered holdings into a disciplined, strategic investment plan.

Multi-Timeframe Market Clarity: Building precision through layered structural reading

Professional traders do not look at a single chart. They build context stacks, evaluating how structure behaves on each timeframe and how these layers interact.

♦ HTF sets the macro environment, directional bias, and long-range liquidity targets

♦ MTF refines areas of interest, inefficiencies, rebalance zones, and momentum decays

♦ LTF reveals microstructure, execution windows, stops placement, and entry precision

♦ Alignment between HTF → MTF → LTF creates clarity, consistency, and confidence

♦ Misalignment creates risk, noise, and emotional misinterpretation

♦ Multi-timeframe mapping prevents traders from entering against dominant flow

Multi-timeframe synergy is what separates intuition-based trading from structured, professional execution.

Imbalance Theory, Efficiency, and Price Delivery: Understanding the energy imprinted inside every move

Every move in the market is either efficient or inefficient.

Inefficiencies expose where price moved too quickly, skipping fair value areas; inefficiencies act like magnets waiting to be filled.

♦ Inefficient moves show aggressive displacement where liquidity overwhelmed resistance

♦ Balanced structure forms when buying and selling are temporarily stabilized

♦ Imbalances often demand revisits as the market seeks equilibrium

♦ Displacement candles signal decisive shifts in liquidity power

♦ Price delivery is the rhythmic process of markets correcting inefficiencies while pursuing liquidity targets

♦ Deep imbalances reveal zones where future reaction is highly probable

♦ Efficient price paths show healthy order flow and trend continuation potential

A trader who sees imbalances understands not only where price went — but where it is required to return.

Reversals, Breakouts & Transitional Architecture: Reading critical pivot zones before they unfold

Most traders recognize reversals only after they happen. Professionals recognize them in their early structural phase, long before the public sees confirmation.

♦ Reversals begin with momentum loss, shallow expansions, and weakening highs/lows

♦ Breakouts only sustain when backed by liquidity expansion, not retail excitement

♦ Failed breakouts often expose trapped liquidity and engineered stop hunts

♦ Transitional structures show hesitation, inefficiency, and energy compression

♦ Trend shifts always originate on lower timeframes before HTF confirms

♦ True reversals require structural invalidation, not just a strong candle

Transitional architecture is the heart of advanced TA.

It reveals when the market is preparing for something major — often before indicators move or social sentiment changes.

Targeted Altcoin Analysis for Smarter Decisions

Get a manually crafted, expert-level breakdown of any altcoin you choose. Understand market structure, fundamentals, risk areas, and potential scenarios with clarity — no noise, no guesswork, just professional insight.

Volume, Volatility & Liquidity Interaction: The energy system powering crypto markets

Volume and volatility are not indicators — they are expressions of participation and energy transfer.

They show when the market is attentive, passive, explosive, or manipulated.

♦ High volatility compresses or expands structural ranges

♦ Volume spikes show meaningful participation and not just noise

♦ Thin liquidity zones lead to wicks, fakeouts, and slippage

♦ Volatility cycles create predictable expansion → compression rhythms

♦ Liquidity voids amplify volatility and structural aggression

♦ Energy transitions reveal the timing of upcoming large moves

When structural analysis is combined with volatility interpretation, the market reveals its internal heartbeat.

Institutional Footprints & Liquidity Behavior: Understanding professional intention hidden inside price

Institutions, whales, automated systems, and advanced operators leave behind recognizable structural patterns.

Crypto is volatile because liquidity is shallow compared to traditional markets — making institutional behavior visible if you know what to look for.

♦ Liquidity hunts expose stop clusters and retail positioning

♦ Breaker structures show zones reclaimed by strong participants

♦ Premium zones attract distribution; discount zones attract accumulation

♦ Whipsaws reveal engineered liquidity grabs

♦ Large players manipulate perception to create asymmetric opportunity

♦ Institutional footprints shape trend, structure, volatility, and sentiment

Retail traders who ignore institutional dynamics lose repeatedly.

Those who embrace them stop being victims and start understanding how markets truly move.

Understand the Market Before It Moves

Get a professional overview of market structure, macro behavior, dominance trends, and major cycles. Designed for traders who want clarity on the broader environment before making critical decisions.

The Professional Technical Analysis Framework: A complete step-by-step structural methodology

A professional TA system is not discretionary.

It is a precise, repeatable, structured methodology based on logic and evidence.

♦ Define HTF bias and environment classification

♦ Mark structural zones, inefficiencies, and liquidity targets

♦ Identify trend strength, momentum, and volatility cycles

♦ Observe transitional behavior and potential inflection points

♦ Drop to LTF for execution windows with minimal risk

♦ Use strict risk management to enforce discipline

♦ Review structure post-trade to reinforce learning

This is the framework used by traders who survive long-term and scale their skill into consistency.

TA becomes a professional tool only when applied with structure, clarity, and repeatable logic.

Common questions

Technical Analysis in crypto is not a collection of tricks or chart patterns — it is a discipline of structural interpretation. Every candle, every expansion, every rejection, every consolidation, and every reversal is the result of underlying liquidity mechanics interacting with narrative flows and volatility cycles.

Most traders lose because they treat TA as a guessing game or a visual puzzle. Professionals, however, treat TA as a systematic process of reading the internal logic of price. They understand that markets move to seek liquidity, rebalance inefficiencies, and resolve energy imbalances across timeframes. They know that transitions occur before reversals become obvious, and that trends communicate strength or weakness long before the public reacts.

The true power of TA is not prediction — it is understanding. Once traders understand the structure beneath the movement, they no longer fear volatility or confusing charts. They gain clarity in uncertainty, confidence in execution, and discipline in risk.

This pillar exists to provide that clarity: a comprehensive framework for interpreting the hidden architecture of crypto markets, transforming randomness into order and emotional decisions into strategic actions. Technical Analysis becomes a superpower only when approached with precision, patience, and a professional mindset — and this is the pathway to develop it.

What is the most important concept to master in Technical Analysis?

The single most important concept in technical analysis is a correct understanding of market structure, because every other component — trend, momentum, liquidity, reversals, volatility, continuation, accumulation, distribution — emerges from structure. Structure is the foundation that organizes chaotic price movement into a readable, logical sequence.

Most traders skip structure and jump directly into indicators, hoping for shortcuts or signals that remove uncertainty. But indicators are only delayed reflections of structure, and without understanding the architecture beneath price, traders misinterpret signals, force trades, and react emotionally instead of analytically.

♦ Market structure shows who is in control: buyers, sellers, or neither

♦ It defines trend, consolidation, compression, transition, and reversal

♦ It reveals the roadmap price is statistically likely to follow

♦ It exposes trapped liquidity, inefficiencies, imbalance zones, and magnet areas

♦ It determines whether volatility will compress, expand, or break direction

When a trader truly understands structure, the market stops feeling random.

They no longer guess what happens next — they read what the market is telling them.

Everything else in TA becomes exponentially easier once structure is mastered.

Why do most traders misinterpret price action even after years of studying charts?

Most traders misinterpret price action because they learn patterns instead of principles. They memorize shapes, signals, candles, and formations instead of learning how markets actually operate. They rely on intuition and “experience,” but not on structural logic.

As a result, they see what they want to see, not what the market is actually presenting.

♦ They understand candles but not liquidity

♦ They see breakouts but not inefficiencies

♦ They recognize trends but not structural exhaustion

♦ They see reversals but not transitional architecture

♦ They look at indicators without knowing the underlying mathematics

Price action is not about candles — it is about the forces that create candles: liquidity behavior, order flow, institutional intention, volatility cycles, and structural transitions.

A trader who focuses on the underlying logic develops clarity.

A trader who focuses on surface-level visuals develops emotional reactions.

The difference between those who succeed and those who fail is not intelligence — it is whether they study why price behaves the way it does, instead of just watching it happen.

How can traders improve their accuracy when timing entries and exits?

Accuracy in entries and exits comes from multi-timeframe synergy, not from a single signal or indicator. The best traders in the world structure their decision-making across layers: macro context, meso-structure alignment, micro-execution windows, and volatility confirmation.

Beginners often trade from one timeframe and then blame randomness when their trade fails. But randomness is usually just a mismatch between the chosen timeframe and the true trend environment.

♦ High Timeframe (HTF) provides the narrative and directional bias

♦ Mid Timeframe (MTF) refines zones, target levels, inefficiencies, and structural pulses

♦ Low Timeframe (LTF) reveals the exact execution point where risk is minimized

♦ Volatility cycles determine whether conditions are favorable or dangerous

♦ Liquidity positioning determines whether the trader is entering into a trap

When all these layers confirm the same idea, entry timing becomes dramatically more precise.

Exits also improve because the trader understands where the move is likely to pause, reverse, or complete its delivery.

Precision is a by-product of structure — not luck.

Can Technical Analysis work consistently in a market as volatile as crypto?

Yes — TA not only works in crypto, it often works better than in traditional markets because crypto’s volatility exposes structural relationships that remain hidden elsewhere.

The issue is not whether TA works; the issue is whether traders apply TA correctly.

Crypto volatility amplifies:

♦ liquidity hunts

♦ structural breaks

♦ imbalance formations

♦ displacement moves

♦ failed retests

♦ transitional compression

♦ engineered volatility traps

♦ institutional footprints

These phenomena make crypto charts incredibly rich for structural analysis.

But traders who use lagging indicators or simplistic patterns misinterpret this richness as randomness.

Professionals who understand structure, momentum behavior, liquidity positioning, and volatility cycles often find crypto more predictable — not less.

TA does not guarantee certainty.

It guarantees context, probabilities, and clarity, which is all a trader needs to operate consistently.