THE PROFESSIONAL FRAMEWORK FOR SURVIVING, SCALING & WINNING IN CRYPTO

RISK & PORTFOLIO SYSTEMS

Risk is not a number.

Risk is a structural discipline.

Portfolio construction is not diversification.

It is engineered exposure across timeframes, volatility layers, liquidity cycles, and asset classes.

This mother page represents the full professional methodology used by high-level traders, quantitative analysts, and institutional desks to prevent collapse, maximize longevity, and scale capital with precision.

Crypto punishes traders who treat risk emotionally.

Professionals survive because they treat risk as engineering, not preference.

Understanding exposure, fragility & systemic vulnerability in crypto

The True Nature of Risk

Crypto markets are fundamentally hostile: 24/7 trading, leveraged derivatives, extreme volatility, thin liquidity, aggressive liquidations, and unpredictable news cycles.

Retail traders think risk is “stop-loss distance.”

Professionals understand risk as multi-dimensional exposure.

♦ Directional risk: how much your outcome depends on one price path

♦ Volatility risk: how strongly your position is affected by sudden expansion

♦ Liquidity risk: the danger of not being able to exit without slippage

♦ Correlation risk: multiple assets moving together, amplifying loss

♦ Concentration risk: too much allocation to a single narrative or coin

♦ Execution risk: psychological or technical failure during volatility

♦ Asymmetric risk: positions with unlimited downside, limited upside

Risk is not what the trader feels — risk is what the system objectively contains.

Professionals survive because they treat risk as a measurable, structured component of trading — not as an afterthought.

Designing a system that survives volatility & grows through narrative cycles

Portfolio Architecture

A portfolio is not a basket of coins.

It is a structured matrix of exposure, divided by time horizon, volatility class, conviction level, and liquidity access.

Institutional portfolio design evaluates:

♦ Core allocations: stable, long-term assets (BTC, ETH, high-conviction chains)

♦ Growth allocations: ecosystems with measurable adoption potential

♦ Speculative allocations: high-upside, high-risk altcoins

♦ Rotational allocations: narrative-driven exposure (AI, L2s, RWA, etc.)

♦ Hedge layer: futures, options, stablecoins, or inverse exposure

♦ Cash buffer: opportunity capital for crashes or discount cycles

A strong portfolio solves problems before they happen:

→ prevents catastrophic losses

→ reduces emotional trading

→ scales responsibly

→ adapts to new narratives

→ avoids blowing up during volatility storms

Portfolio architecture is the engine of professional longevity.

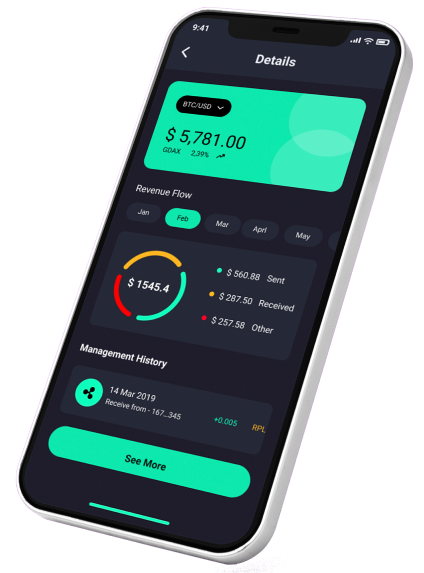

Portfolio Strategy Built Around Your Goals

Receive a complete, coin-by-coin analysis of your portfolio with structured risk evaluation, allocation guidance, and clear improvement suggestions. Turn scattered holdings into a disciplined, strategic investment plan.

Position Sizing Mastery: Engineering exposure with mathematical precision

The biggest cause of retail blow-ups is oversized positions.

Professionals determine position size using structural logic, not emotion.

♦ Volatility-adjusted sizing: higher volatility → smaller size

♦ Conviction-weighted sizing: stronger research → larger size

♦ Liquidity-adjusted sizing: avoid large positions in thin markets

♦ Correlation-adjusted sizing: account for assets moving together

♦ Dynamic sizing models: increase size during stable conditions, reduce during high instability

♦ Risk-per-trade frameworks: 0.5%–2% depending on system maturity

Position sizing is the difference between:

– a losing streak that kills an account

– a losing streak that is irrelevant and recoverable

The position is not the risk — the size is the risk.

Risk Layers: Understanding exposure across timeframes, environments & volatility regimes

Professional traders separate risk into layers — because risk behaves differently under different conditions.

♦ HTF risk: macro trends, liquidity cycles, global narratives, risk-on/off behavior

♦ MTF risk: ecosystem rotation, chain congestion, unlock events

♦ LTF risk: execution timing, volatility spikes, stop cascades

♦ Environmental risk: trending vs ranging vs transitional markets

♦ Structural risk: imbalances, displacement zones, liquidity voids

By recognizing which layer is active, traders avoid the classic trap of using the wrong risk model for the current market environment.

Risk is dynamic — and professionals adjust in real time.

Failure Modeling & Scenario Simulation: Predicting bad outcomes before they occur

Institutions do not ask, “What if the trade works?”

They ask:

“What are all the ways this can fail — and how do we survive them?”

♦ Failure scenarios from volatility shocks

♦ Leverage cascades and forced liquidations

♦ Funding rate regime changes

♦ Narrative breaks and liquidity exits

♦ Network outages or exploit events

♦ Massive unlocks hitting supply

♦ Correlated downturns across narratives

Professionals mentally simulate:

→ worst-case scenario

→ base-case scenario

→ best-case scenario

This gives them control when retail traders panic.

Targeted Altcoin Analysis for Smarter Decisions

Get a manually crafted, expert-level breakdown of any altcoin you choose. Understand market structure, fundamentals, risk areas, and potential scenarios with clarity — no noise, no guesswork, just professional insight.

Emotional Risk & Cognitive Fragility: The psychological layer that destroys traders

The mind is the biggest risk factor.

♦ Loss aversion: holding losers too long

♦ FOMO impulse: entering breakouts too late

♦ Revenge trading: emotional attempts to recover losses

♦ Overconfidence: sizing too large after wins

♦ Panic exits: selling at liquidity sweeps

♦ Bias stacking: seeking confirmation instead of truth

Professionals engineer systems that bypass emotional fragility:

→ predefined stop levels

→ automatic position sizing

→ structured routines

→ strict trading playbooks

→ cooldown periods after losses

Psychology doesn’t improve by wishing — it improves by engineering behavior.

Adaptive Portfolio Rotation: Adjusting exposure through market cycles, narratives & liquidity flows

Crypto goes through continuous macro cycles:

→ Accumulation

→ Early Uptrend

→ Expansion

→ Distribution

→ Collapse

→ Reset

Professionals rotate portfolios based on:

♦ liquidity inflows into specific narratives

♦ risk-on vs risk-off macro behavior

♦ volatility compression / expansion

♦ BTC dominance shifts

♦ altcoin season probability

♦ chain-specific adoption surges

♦ funding rate dynamics

Portfolio rotation is how professionals compound during expansions and protect capital during contractions.

Understand the Market Before It Moves

Get a professional overview of market structure, macro behavior, dominance trends, and major cycles. Designed for traders who want clarity on the broader environment before making critical decisions.

The Institutional Risk Framework: A complete, repeatable system for survival & growth

This is the exact model used by professionals:

♦ Define risk per trade → never break it

♦ Structure the portfolio → core/growth/speculative/hedge

♦ Size positions mathematically → volatility & conviction weighted

♦ Identify active risk layer → HTF/MTF/LTF/environment

♦ Simulate failure scenarios → prepare before entering

♦ Control psychological triggers → eliminate emotional trading

♦ Rotate exposure through cycles → align with market structure

♦ Review system performance → adapt, refine, scale

Risk is not defensive — risk is the foundation of growth.

Portfolio engineering is not optional — it is survival.

Common questions

Risk and portfolio engineering are the foundation of every professional trading system. Without them, even brilliant strategies eventually collapse under the weight of volatility, emotional pressure, leverage risks, and liquidity traps.

Risk is not something traders “think about” after they enter a position — it is the structural backbone that determines whether their capital survives long enough to experience compounding.

Professional traders operate with an entirely different mindset from retail: they assume loss before profit, instability before stability, and volatility before clarity.

They build systems designed to absorb shocks, manage uncertainty, and maintain psychological balance during chaotic markets.

Their edge comes not from perfection, but from resilience.

Portfolio construction is equally critical.

A portfolio is a living system engineered to grow through cycles, adapt to narrative rotations, withstand macro shocks, and align exposure with conviction and market structure.

Professionals understand that risk cannot be eliminated — but it can be shaped, distributed, and controlled.

Their portfolios reflect intentional design: core positions for stability, growth positions for narrative alignment, speculative positions for asymmetric upside, and hedge layers for protection during market stress.

This framework transforms trading from emotional gambling into strategic capital management.

The goal is not to win every trade.

The goal is to survive every environment — and scale during favorable ones.

Why do traders fail even when they have a good strategy?

Most traders fail not because their strategy is bad, but because their risk architecture is fundamentally broken. A strategy determines where you enter; risk determines whether you survive the inevitable drawdowns, volatility shocks, liquidation cascades, and psychological failures that occur in crypto.

Professionals know that even the best strategy cannot outperform a weak risk system.

♦ Position sizing errors: Traders size positions emotionally instead of mathematically, turning small drawdowns into catastrophic losses.

♦ No volatility adjustment: Crypto volatility constantly changes; rigid sizing destroys accounts during volatility expansion.

♦ Correlation blindness: Holding multiple assets that move together creates hidden exposure far larger than expected.

♦ No failure scenario modeling: Without preparing for worst-case outcomes, traders break rules under pressure.

♦ Emotional execution: Fear, revenge, overconfidence, and impatience distort the strategy’s logic.

♦ Lack of system-level discipline: Even a good strategy loses if the trader cannot execute it consistently over time.

A strategy generates opportunities — but risk engineering determines whether those opportunities lead to growth or ruin.

Professionals don’t rely on strategy alone; they build an environment where their strategy can survive long enough to become profitable.

How do professionals calculate position size in volatile markets like crypto?

Professionals never guess their position size. They follow mathematical frameworks that adjust dynamically based on volatility, liquidity, conviction, and systemic risk.

Crypto requires a more advanced approach because volatility is extreme and liquidity varies significantly across assets.

♦ Volatility-weighted sizing: Higher volatility → smaller size. Lower volatility → larger size.

♦ Conviction-weighted sizing: Higher research confidence or stronger narrative → larger base allocation.

♦ Liquidity-adjusted sizing: Thin order books require tiny exposure to avoid slippage catastrophes.

♦ Correlation-adjusted sizing: If multiple assets correlate, position sizes must be reduced collectively.

♦ Risk-per-trade allocation: Professionals rarely risk more than 0.5%–2% of total capital per idea.

♦ HTF context sizing: Bigger size during stable, trending conditions; smaller size during transitional environments.

Position sizing is not flexible — it is engineered.

Professionals build systems where even a series of losing trades cannot damage the account.

Retail traders gamble on outsized positions; professionals build positions that respect the market’s danger.

What is the purpose of portfolio diversification, and why does most retail “diversification” fail?

Real diversification is not about holding many coins — it is about managing exposure across different volatility classes, narratives, liquidity profiles, and time horizons.

Retail diversification fails because it is superficial, not structural.

♦ Holding 20 correlated altcoins is not diversification. It is doubling or tripling the same risk.

♦ Diversifying by “hype” categories fails because narratives collapse together when market conditions shift.

♦ Lack of hedge layers leaves portfolios exposed to market-wide corrections.

♦ Poor allocation weighting causes small-cap exposure to dominate unintended risk.

♦ No rotation logic means portfolios become static and decay during macro transitions.

True diversification includes:

→ core assets (BTC/ETH)

→ growth assets (strong L1s, L2s, or infrastructure plays)

→ speculative small caps

→ liquidity hedges (stables, futures, inverse exposure)

→ narrative rotation capital

Professionals diversify by risk type, not by coin count.

This is why their portfolios survive crashes and rebound efficiently.

How do professionals avoid emotional mistakes during high volatility and losing streaks?

Professionals do not rely on “discipline” or “mental strength.”

They rely on pre-engineered systems that remove emotion from execution.

♦ Predefined risk limits: Never adjusted mid-trade.

♦ Structured routines: Execution is rule-based, not reactive.

♦ Cooldown periods: No trading after major losses or emotional triggers.

♦ Automated sizing rules: No manual adjustments based on fear or greed.

♦ Scenario mapping: Professionals visualize failure before it happens, reducing shock and panic.

♦ Process over outcome: They grade themselves on execution quality, not PnL fluctuations.

♦ Environmental awareness: Recognizing dangerous volatility regimes prevents emotional misreads.

Retail traders try to “control emotions.”

Professionals design systems where emotions cannot influence decisions.

This is the true psychological edge — not willpower, but engineering.