THE ULTIMATE FOUNDATION FOR NEW TRADERS

CRYPTO BEGINNER EDUCATION

Unlock the clearest, most structured path into crypto.

From blockchain basics to market structure, volatility, and beginner risk skills — this guide gives you everything you need to trade confidently, safely, and intelligently.

Understanding Blockchain

The foundation beneath everything in crypto

Crypto begins with a single concept: a trustless, decentralized ledger capable of storing value, executing logic, and verifying transactions without a central authority.

To understand markets, volatility, price movement, tokens, altcoins, stablecoins, or even exchanges, beginners must first understand what powers it all.

♦ Blockchain is a distributed network of nodes that collectively agree on the state of truth.

♦ Every block contains a verifiable history of transactions, cryptographically linked to the previous one.

♦ Data cannot be changed, reversed, or manipulated without breaking cryptographic integrity.

♦ Consensus mechanisms — Proof of Work, Proof of Stake, and hybrid models — determine how networks reach agreement.

♦ Smart contract platforms allow entire digital economies to run autonomously.

A beginner who understands blockchain understands why crypto exists — and why it will not disappear.

This section creates the mental foundation needed for every advanced topic to make sense later.

Digital value, system incentives, and the categories every beginner must know

What cryptocurrencies actually are

Crypto is not just “internet money.” It is a diverse ecosystem of assets, each with a different purpose and risk level. New traders must learn how to distinguish the categories, because misunderstanding utility is one of the main causes of beginner losses.

♦ Bitcoin → store of value, monetary asset, low-utility high-conviction macro asset

♦ Ethereum → programmable global computer powered by smart contracts

♦ Altcoins → tokens built for utility, speculation, ecosystem expansion, or experimentation

♦ Stablecoins → tokenized dollars for payments, trading, hedging, liquidity generation

♦ Utility tokens → fuel for blockchains, applications, and decentralized environments

♦ Governance tokens → voting rights over DAOs and protocols

Once beginners recognize categories, they begin to understand why price moves differently across assets, and why narratives form powerful waves in altcoin markets.

Portfolio Strategy Built Around Your Goals

Receive a complete, coin-by-coin analysis of your portfolio with structured risk evaluation, allocation guidance, and clear improvement suggestions. Turn scattered holdings into a disciplined, strategic investment plan.

Wallets & Security: Protecting digital value with responsible practices

The first real moment of independence in crypto is learning how to store wealth properly. Wallets are the beginner’s firewall against theft, phishing, exchange failures, and irreversible mistakes.

A beginner who understands wallets understands responsibility.

♦ Custodial wallets → managed by exchanges, easy but riskier

♦ Non-custodial wallets → you hold your private keys; security is in your hands

♦ Hardware wallets → maximum security through offline key storage

♦ Seed phrases → the single most important security element every beginner must protect

♦ Transaction signing → the moment your wallet authorizes on-chain actions

When new traders master wallet fundamentals, they eliminate the top risk that destroys beginner portfolios: losing funds through inexperience rather than market movement.

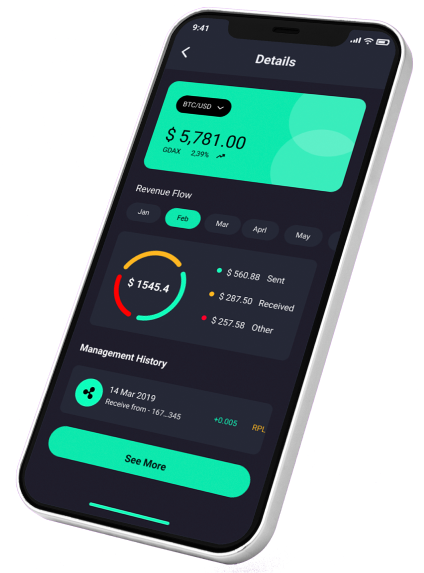

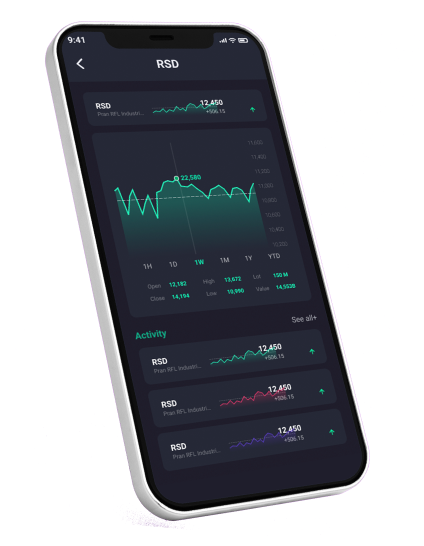

Exchanges, market mechanics, and the basic order structures behind buying & selling

Exchanges are the interface through which beginners access crypto markets.

To trade effectively, they must understand how markets actually operate.

♦ Order books show how buyers and sellers compete for price

♦ Bid–ask spreads define liquidity quality

♦ Market orders vs limit orders determine execution behavior

♦ Centralized exchanges (CEX) handle custody and simplify the experience

♦ Decentralized exchanges (DEX) operate through smart contract liquidity pools

♦ Fees, slippage, liquidity depth, and execution speed influence every transaction

Without understanding these mechanics, beginners make poor entries, terrible exits, and often misinterpret why a trade went wrong.

Market structure fundamentals: trends, reversals, pullbacks, breakouts, and the psychology beneath price

Before learning advanced technical analysis, every beginner must master the basic structural language of markets.

Crypto is volatile, but volatility is not randomness — it is structured behavior.

♦ Trends → directional waves that define the dominant movement

♦ Pullbacks → corrective phases within trends

♦ Breakouts → structural escapes from consolidation or compression

♦ Reversals → pivots that signal a shift in control between buyers and sellers

♦ Support & resistance → historically significant zones of reaction

Market structure is not optional knowledge.

Every beginner who skips the fundamentals of price behavior eventually misreads the market, enters too early, exits too late, or trades against momentum without realizing it.

Targeted Altcoin Analysis for Smarter Decisions

Get a manually crafted, expert-level breakdown of any altcoin you choose. Understand market structure, fundamentals, risk areas, and potential scenarios with clarity — no noise, no guesswork, just professional insight.

Volatility, market cycles, dominance, and macro behavior: understanding crypto’s energy system

Crypto moves faster than any other asset class because information, liquidity, and sentiment transmit instantly. New traders must understand the forces that drive these moves.

♦ Volatility represents compressed or explosive energy

♦ Bitcoin dominance influences altcoin survivability and timing

♦ Market cycles follow accumulation → expansion → distribution → decline

♦ Macro shifts (rate changes, liquidity cycles, global risk appetite) affect the entire crypto economy

♦ Altseason arises when liquidity rotates from majors into speculative ecosystems

When beginners learn to read the macro rhythm, they stop trading emotionally and start trading structurally.

Risk basics: understanding leverage, margin, fees, and the dangers beginners underestimate

Every new trader must understand that crypto is not dangerous — ignorance is.

Risk is manageable when knowledge replaces emotion.

♦ Leverage amplifies movement but also amplifies liquidation risk

♦ Margin determines how much borrowed capital you use

♦ Perpetual futures introduce funding rates and directional pressure

♦ Stop-loss levels protect capital, not “limit gains”

♦ Misunderstanding liquidation mechanics is the #1 cause of beginner blow-ups

Beginners who grasp risk fundamentals early avoid the catastrophic mistakes that destroy most new portfolios within their first months.

Understand the Market Before It Moves

Get a professional overview of market structure, macro behavior, dominance trends, and major cycles. Designed for traders who want clarity on the broader environment before making critical decisions.

The structured beginner roadmap: from zero → competent → confident participant

Becoming a capable crypto participant does not require special talent — only structured progression.

This final section serves as a complete learning map for beginners.

♦ Phase 1 → Understand blockchain, wallets, transactions, exchanges

♦ Phase 2 → Learn the basic market concepts: trend, volatility, structure

♦ Phase 3 → Build personal security habits

♦ Phase 4 → Understand market cycles, dominance, macro context

♦ Phase 5 → Learn beginner-level trading concepts and risk fundamentals

♦ Phase 6 → Transition into intermediate topics: liquidity, market structure, TA

♦ Phase 7 → Begin exploring advanced domains (future expansion of this pillar)

This roadmap ensures the beginner does not jump ahead, burn capital, or get overwhelmed.

It creates a clear path toward mastery — one that naturally leads into your four other pillars: TA, Liquidity, Fundamentals, and Risk Systems.

Common questions

Crypto is one of the most transformative financial systems ever created, but beginners often underestimate how important structured education is. The difference between a confident participant and a struggling newcomer is rarely talent — it is clarity.

Clarity about how blockchain functions. Clarity about how wallets secure digital value. Clarity about how market mechanics, trends, volatility, and risk operate beneath the surface.

Once these foundations are established, the entire crypto world becomes easier to understand. Traders begin to recognize why price moves, why narratives emerge, why liquidity shifts create opportunity, and why disciplined risk practices protect portfolios during chaotic conditions.

This beginner pillar exists to remove confusion and deliver a clean, professional roadmap for anyone entering crypto. It condenses the core concepts that matter, organizes them into a logical sequence, and creates a learning environment where progress is predictable rather than overwhelming.

Whether someone wants to trade actively, invest long-term, or simply navigate the ecosystem safely, this guide provides the structure needed to grow from complete beginner to confident participant. Crypto rewards knowledge — and this is where knowledge begins.

What is the safest way for a beginner to start learning crypto?

The safest way for a beginner to enter crypto is by building a progressive foundation, rather than rushing into trading or altcoin speculation. A beginner should first understand how blockchain works, how wallets store and protect digital value, how exchanges handle transactions, and how fees, spreads, and market mechanics operate.

Only after mastering these principles should a beginner move toward understanding volatility, trend behavior, and market structure — the elements that shape how price truly moves.

Security must also be prioritized immediately. Beginners should learn the difference between custodial and non-custodial wallets, understand how seed phrases work, and practice recognizing common scams such as phishing, fake airdrops, manipulated tokens, or misleading social media promotions.

By combining education, security, structured learning, and patience, a beginner can enter crypto in a way that minimizes risk and maximizes long-term skill development.

Why do most new crypto traders lose money?

Most beginners lose money because they enter the market emotionally rather than structurally. They see volatility, momentum, and hype, and assume that fast movement equals fast profit. In reality, crypto markets are powered by liquidity mechanics, behavioral cycles, hidden risk pockets, and structural shifts that beginners rarely understand.

A new trader typically enters too late during excitement, exits too early during fear, relies on intuition instead of structure, ignores risk management, and misunderstands how leverage and liquidation actually work.

Furthermore, beginners rarely understand market cycles, dominance shifts, narrative evolution, or the broader macro environment that heavily influences crypto.

Losses occur not because the trader is incapable — but because they have not yet learned how markets function beneath the surface. With strong foundations, even a beginner can dramatically reduce emotional mistakes and start making consistent, rational decisions.

What are the essential concepts every beginner should master before trading?

Every beginner must understand six core areas before executing any trade:

♦ Blockchain fundamentals — how data is stored, verified, and secured

♦ Wallet security — seed phrases, private keys, hardware wallets

♦ Exchange mechanics — order types, fees, slippage, liquidity, spreads

♦ Market structure basics — trend, pullback, breakout, reversal, consolidation

♦ Volatility behavior — why crypto moves violently and how energy compresses or expands

♦ Risk fundamentals — stop-loss, liquidation, margin, leverage, exposure control

A trader who internalizes these principles has an enormous advantage over beginners who skip directly to trading strategies.

Understanding these basics transforms crypto from a confusing environment into a logical, structured system.

How long does it take to become confident in crypto?

Confidence in crypto does not come from luck or short-term wins — it comes from structured learning and repeated clarity.

Most beginners begin to feel stable after 4–8 weeks of studying fundamentals: understanding blockchain, wallets, exchanges, basic market structure, and core risk principles.

A deeper level of confidence develops around the 3–6 month mark, when the trader begins to recognize market patterns, differentiate between noise and structure, interpret price behavior, and understand how to protect capital during volatility.

Crypto mastery is not a rush. Because the market is fast and emotional, traders who learn slowly and methodically often outperform those who try to sprint.

Confidence is built through education, exposure, and consistency, not through reckless trading.