A long-form authority guide for smarter crypto decisions

Mastering Altcoin Research: The Complete Guide to Evaluating Crypto Projects Before Investing

Successful crypto investors don’t rely on hype, signals, or luck. They rely on research.

Understanding how to evaluate an altcoin properly — before you commit capital — is one of the most powerful skills in digital asset investing. It helps you avoid unnecessary risks, identify promising opportunities early, and build a long-term strategy that outperforms emotional decision-making.

This guide presents a complete, evergreen framework for analyzing any crypto project using both fundamental and technical methods. Whether you’re a beginner or an active investor, mastering this process gives you clarity, confidence, and a professional edge in the market.

How to Identify the Core Strengths Behind Any Crypto Project

What Gives an Altcoin Real Value?

Before looking at charts, social metrics, or market narratives, you must understand what makes a project fundamentally valuable.

Strong altcoins share three core qualities:

utility, healthy token economics, and consistent development.

• Utility (A Real Problem + A Real Solution)

A crypto project must solve a specific problem and offer a meaningful use-case.

If you cannot clearly explain what the project does and why blockchain is important for it, the long-term potential is questionable.

• Sustainable Tokenomics

Tokenomics determine whether the token can hold value over time or is destined for dilution. Important elements include:

total and circulating supply

vesting schedules

unlock events

distribution among insiders, community, and ecosystem

emission model

Unbalanced tokenomics can cause long-term selling pressure even if short-term price action looks strong.

• Active and Transparent Development

A solid project evolves continuously. Look for:

ongoing development activity

visible code updates

progress on deliverables

transparent communication from the team

Projects that stagnate or go silent usually lose relevance quickly.

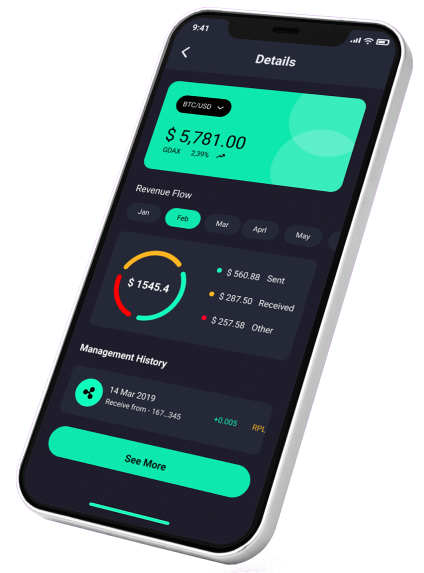

Portfolio Strategy Built Around Your Goals

Receive a complete, coin-by-coin analysis of your portfolio with structured risk evaluation, allocation guidance, and clear improvement suggestions. Turn scattered holdings into a disciplined, strategic investment plan.

A Professional, Evergreen Approach for Evaluating Any Crypto Project

The Complete Framework for Fundamental Analysis

Fundamental analysis helps you understand the underlying strength of a project beyond its price.

Below is a professional, evergreen research process that works for every altcoin.

• Narrative & Sector Positioning

Every project belongs to a broader narrative such as infrastructure, scaling, DeFi, AI, gaming, or real-world utility.

Understanding the narrative helps you evaluate long-term demand and relevance.

Ask:

Is the narrative growing or shrinking?

Does the project solve a real problem inside this sector?

How does it compare with competitors?

• Whitepaper and Core Architecture

You don’t need to read 40 technical pages. Focus on:

the problem and proposed solution

key features

architecture and mechanics

token utility

roadmap structure

If the concept sounds vague or recycled, treat it as a warning sign.

• The Team Behind the Project

Credibility, experience, and transparency matter.

Strong teams demonstrate:

consistent communication

proof of development

real backgrounds or on-chain history

technical competence

A weak or anonymous team without verifiable activity raises risk significantly.

• Token Utility (What the Token Actually Does)

A token should have practical use within the protocol.

Common utilities include governance, transaction fees, staking, network security, or access mechanics.

Tokens without real utility typically fail to maintain value over time.

• Roadmap Realism

A valid roadmap is realistic, structured, and measurable.

Always check whether the project:

has delivered previous milestones

is moving consistently toward new ones

avoids constant delays or dramatic redirections

Delivering on promises is a major indicator of long-term strength.

• Liquidity and Market Depth

Liquidity is an often overlooked but key pillar of safety.

Low liquidity makes a coin vulnerable to manipulation, sudden price crashes, and unreliable market structure.

Evaluate:

order book depth

spread consistency

stability of volume

presence of healthy market activity

• Token Distribution and Unlock Risks

This is one of the most critical components of research.

Inspect how tokens are allocated among:

team

private investors

community

ecosystem funds

Large insider allocations or upcoming unlocks can create intense selling pressure.

If distribution looks unhealthy, walk away.

Targeted Altcoin Analysis for Smarter Decisions

Get a manually crafted, expert-level breakdown of any altcoin you choose. Understand market structure, fundamentals, risk areas, and potential scenarios with clarity — no noise, no guesswork, just professional insight.

Reading Price Structure and Market Behavior With Clarity

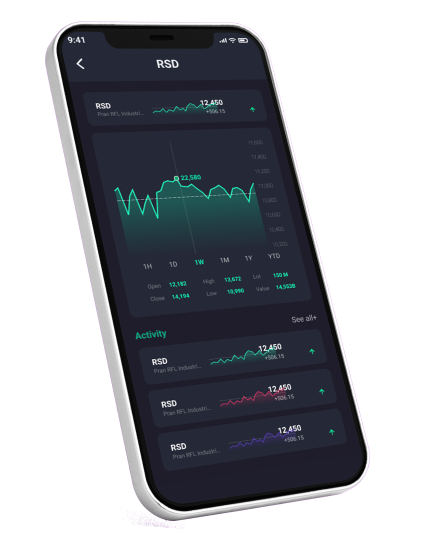

The Technical Analysis Component

Technical analysis helps you understand price behavior, liquidity zones, and market psychology.

It should support, not replace, fundamental research.

• Market Structure and Trend

Identify:

directional bias

clear higher highs or lower lows

breaks of structure

consolidation zones

liquidity sweeps

This shows where smart money is likely positioned.

• Volume Profile and Participation

Instead of only checking volume spikes, analyze where the volume is appearing.

Volume clusters reveal interest from larger participants and help identify strong support and resistance.

• Useful Indicators for Confirmation

Indicators should be used as supportive tools:

moving averages

momentum oscillators

divergence signals

on-balance volume

volatility indicators

They help confirm sentiment but should never be the sole basis for a decision.

• Volatility and Risk Zones

Study price behavior to detect:

liquidity traps

exhaustion points

fake breakouts

manipulation patterns

whale-driven movements

This helps identify rational entry zones instead of emotional ones.

Recognizing Hidden Risks Before They Become Costly Mistakes

Red Flags That Should Make You Avoid a Project

Not all altcoins deserve your attention.

Common warning signs include:

vague or unrealistic promises

a roadmap full of buzzwords but no execution

artificial hype with weak fundamentals

poor transparency from the team

unbalanced token distribution

suspicious volume patterns

sudden social media spikes with no real progress

Even one strong red flag can be enough reason to step away.

Why smart entries and emotional control matter more than predictions

Timing & Psychology — The Two Forces That Define Every Altcoin Decision

Even when a project shows strong fundamentals, choosing the right moment to enter is crucial. Well-timed entries often happen during structured market conditions such as accumulation phases, retests of meaningful levels, or periods of consolidation where price stabilizes after volatility. Neutral sentiment combined with clear technical confluence usually offers the most balanced risk-to-reward environment.

On the contrary, entering during hype-driven breakouts, euphoric optimism, parabolic movements, or emotionally charged social cycles often leads to overextension and unnecessary risk. These phases distort market structure, encouraging emotional decisions rather than rational analysis.

Beyond timing, investor psychology plays an equally critical role. Even with perfect research and well-designed strategy, emotions can undermine performance. Fear and impatience create panic selling, while greed pushes investors to chase volatility or abandon their plans entirely. Consistency, discipline, and structured decision-making protect long-term performance far more effectively than attempting to predict short-term market direction.

Bringing clarity, structure, and confidence to your research process

Final Evaluation & Strategic Takeaways

Before committing to any altcoin, ensure that your analysis confirms the essential pillars of long-term viability: real utility, sustainable tokenomics, active development, balanced token distribution, solid liquidity, and a technical structure aligned with fundamental strength. A trustworthy project fits within your broader strategy and shows no major red flags.

When these criteria align, your decision is based on structure — not emotion or market noise. This disciplined approach creates a more stable, predictable, and professional investing experience.

Altcoin research is not about chasing the next explosive move; it’s about building a reliable framework that helps you evaluate projects with clarity and confidence. By applying this process consistently, you move from reactive investing to strategic decision-making — and that shift is what separates long-term winners from temporary participants.

Understand the Market Before It Moves

Get a professional overview of market structure, macro behavior, dominance trends, and major cycles. Designed for traders who want clarity on the broader environment before making critical decisions.